Electric Cars

Electric car sales took off across major car markets in 2023

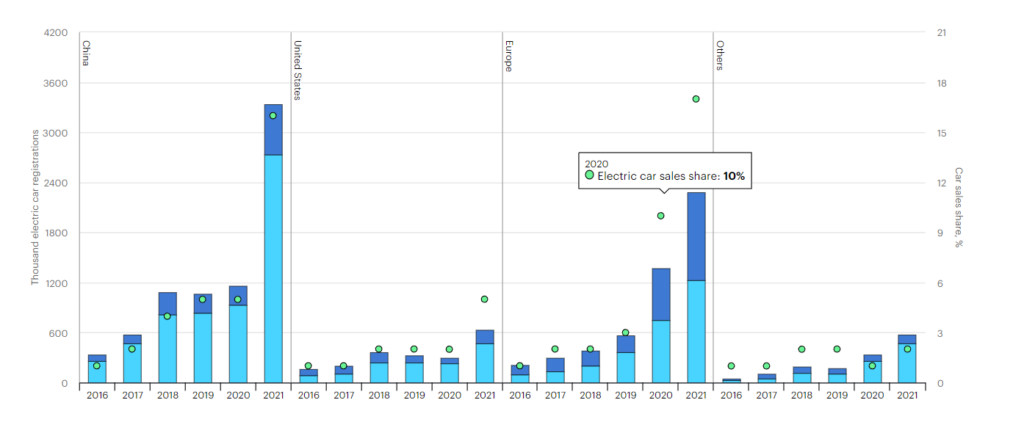

Electric car sales reached a record high in 2021, despite supply chain bottlenecks and the ongoing Covid-19 pandemic. Compared with 2020, sales nearly doubled to 6.6 million (a sales share of nearly 9%), bringing the total number of electric cars on the road to 16.5 million. The sales share of electric cars increased by 4 percentage points in 2021. The Net Zero Emissions by 2050 Scenario sees an electric car fleet of over 300 million in 2030 and electric cars account for 60% of new car sales. Getting on track with the Net Zero Scenario requires their sales share to increase by less than 6% percentage points per year.

EVs avoid oil consumption

The global EV fleet in 2021 consumed about 50 TWh of electricity, which accounts for less than 0.5% of the current total final electricity consumption worldwide. The use of EVs displaced around 0.3 Mb/d of oil in 2021. EVs would need to displace more than 7 Mb/d of oil in 2030 to be in step with the Net Zero Scenario.

Battery energy density is increasing and alternative chemistries are being developed

Energy density is key to ensuring that BEVs have sufficient range. The energy density of batteries for EVs has been rising over the past year, and now some of the highest performing battery cells can reach energy densities of over 300 Wh/kg, up from around 100-150 Wh/kg a decade ago – meaning that with the same mass, electric cars can now travel twice as far. This progress has been made thanks to continuous improvement in battery chemistry and cell design. Key examples of this include Tesla’s upcoming 4680 cells and LG Energy Solution’s Ultium cells.

It is not all about energy density, though. Reducing the need for critical metals is also a priority for EV innovation. The past year has seen a doubling in the market share of lithium iron phosphate (LFP) cathodes, which require no nickel or cobalt. This was in part thanks to innovative cell-to-pack technologies that enable a higher pack density by reducing pack dead weight, but mainly due to automakers switching to LFP to reduce commodity price exposure. Another key development has been the announcement of important supply chain development for sodium-ion batteries by the world’s largest battery manufacturer, CATL. This technology has the potential to completely avoid the use of critical metals. The IEA’s assessment of sodium-ion technology has increased from TRL 3-4 to TRL 6.

Expenditure on EVs and investment in the supply chain is increasing

In 2021 consumers across the world spent an estimated USD 250 billion on EV purchases. The growth in EV sales is driving investment in electrification, which represented more than 65% of overall end-user investment in the transport sector in 2021. A recent analysis by the IEA estimates that this share will increase to more than 74% in 2022. Moving beyond cars, investment is also being directed toward electrification of buses and heavy-duty trucks. In early 2022 India ran a tender for the purchase and deployment of more than 5 000 electric buses across five major cities. The contract was awarded for half the price reached in previous tenders. A public–private joint venture in Chile is also seeking financing to fund a 1 000-strong electric bus fleet in Santiago.

The global production capacity of batteries is set to increase from below 200 GWh in 2019 to over 1 200 GWh in 2024, following massive capital expenditure by listed battery manufacturing companies in 2021, rebounding from a large dip during the pandemic. These companies are now investing three times as much as they did in 2020. In 2021 China led global battery manufacturing capacity by controlling around 75% of the world’s total, followed by the United States, Hungary, and Germany.

Governments announced more ambitious zero-emission vehicle targets and policies in 2021 than ever before

New zero-emission vehicle (ZEV) sales targets were announced in several markets and existing targets were intensified as governments demonstrated a strong commitment to incorporating the electrification of cars as a key component of strategies to meet net-zero targets and nationally determined contributions. They include:

- An executive order in the United States in August 2021, set a new ambition for EVs to represent 50% of LDV sales in 2030.

- In October 2021, an announcement of ambitions to have 100% zero-emission LDV sales by 2035 in Chile.

- In Canada, a new target is to achieve 100% zero-emission LDV sales by 2035 instead of 2040. New interim targets of 20% zero-emission LDV sales by 2026 and 60% by 2030 were also established.

Several governments increased the stringency of vehicle emission standards to further facilitate ZEV deployment. The United States finalized rulings establishing more stringent standards for both corporate average fuel economy and GHG emissions. In the European Union, the European Commission’s Fit-for-55 package includes a regulation, recently passed by the European Commission, that requires fleet emission reductions (from a 2021 starting point) of 55% for cars and 50% for vans by 2030, and 100% for both by 2035. This effectively mandates that all new cars and vans sold from 2035 onward would need to emit zero tailpipe emissions.

Overall, government expenditure on electric car subsidies almost doubled in 2021. Major changes include the following:

- China extended its NEV subsidy scheme to the end of 2022 (from a previous 2020 expiry date), although it has started reducing base subsidy amounts by 10%, 20%, and 30% each year (between 2020 and 2022). It further extended a purchase tax exemption for NEVs through the end of 2023.

- In Korea, the new subsidy scheme introduced in 2021 limited subsidies to passenger cars priced less than KRW 90 million (USD 78 671), while in 2022 subsidies were limited to cars priced less than KRW 55 million (USD 48 077).

- The Build Back Better Act in the United States was drafted in 2021 and proposes a restructuring of EV purchase subsidies to include an additional USD 4 500 for EVs equipped with batteries manufactured with union labor, on top of a USD 7 500 base incentive. More recently, the passage of the Inflation Reduction Act extends tax credits for electric vehicles that meet certain criteria (regarding battery mineral mining and processing and domestic final assembly) and expands credits to used EVs. Finally, California passed a regulation requiring that all cars sold by 2035 be zero-emission vehicles, a mandate that is likely to be followed by many Section 177 States.

- Following a doubling of its subsidies in December 2020, Japan announced a budget allocating JPY 25 billion (USD 228 million) for ZEV subsidies.

In 2021 ZEV deployment was also supported by a sweep of announcements on funding packages to build out supporting infrastructure. Governments also announced industrial strategies that aim to create and expand their prominence within integrated supply chains, so as to futureproof their economies and support domestic production.